Tax season can be daunting for small business owners, but with careful preparation and organization, you can navigate it smoothly...

Selecting the right Certified Public Accountant (CPA) for your business is a critical decision that can significantly impact your financial...

Let’s pretend you lose track of time and miss the tax return deadline. Don’t worry! This isn’t as scary as...

Understanding taxes can be a little tricky, so you’re not alone if you’ve ever found yourself scratching your head, trying...

Though often perceived as a mundane aspect of life, the timely submission of your tax returns plays an integral role...

Welcome to Wichita Tax Advisors’ blog! With tax season fast approaching, we understand the anxiety that comes with getting your...

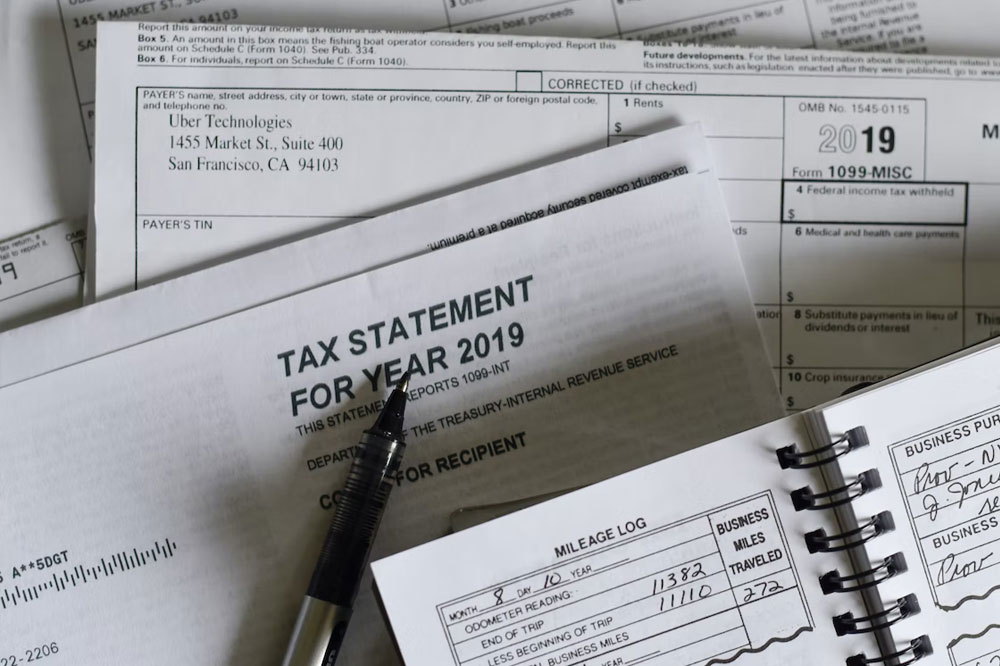

Every year, as seasons change and the end of the fiscal year draws closer, small business owners like you face...

Managing income from various sources is becoming increasingly common in today’s diverse economy. With multiple streams of revenue, individuals need...

Whether you’re a business owner, investor, or simply interested in understanding the financial health of an organization, grasping the fundamentals...

As tax season approaches, many tax payers are eager to learn how their tax refund is calculated. The process of...

Filing taxes is a requirement for most of us—what happens if you decide not to file a tax return? Filing...

Certified public accountants (CPAs) can assist organizations and individuals with various tasks related to finances, taxes, insurance, and more. Learn...