Certified public accountants (CPAs) can assist organizations and individuals with various tasks related to finances, taxes, insurance, and more. Learn more about what a CPA can do to help you or your business and who provides oversight of these professionals.

What is a CPA?

A certified public accountant is a licensed professional accountant. Each state issues its own CPA licenses, and CPAs must hold a license in the state where they intend to practice.

The CPA designation signifies a higher professional standard than others in the accounting industry. Those who want to become a CPA must pass an examination called the Uniform CPA exam. The Uniform CPA exam is known for being thorough and rigorous.

In addition to passing the Uniform CPA exam, people must meet specific work, education, and examination standards. They must hold a bachelor’s degree in finance, accounting, or business administration. They must also have at least two years of public accounting experience.

Certified public accountants can hold positions in public or corporate accounting. They may also fill executive positions, such as a company’s chief financial officer (CFO).

Who Regulates CPAs?

In Kansas, the Kansas Board of Accountancy regulates CPAs. It is the regulatory body that carries out the laws and regulations that govern CPAs in this state.

The mission of the Kansas Board of Accountancy is to identify accountants who have met state qualifications in higher education, experience, ability, and dedication. The Kansas Board of Accountancy offers information on taking the CPA examination, pre-evaluation of college credits, registration assistance, and more.

What Can a CPA Do?

Certified public accountants can perform a wide range of services, including:

- Accounting

- Auditing

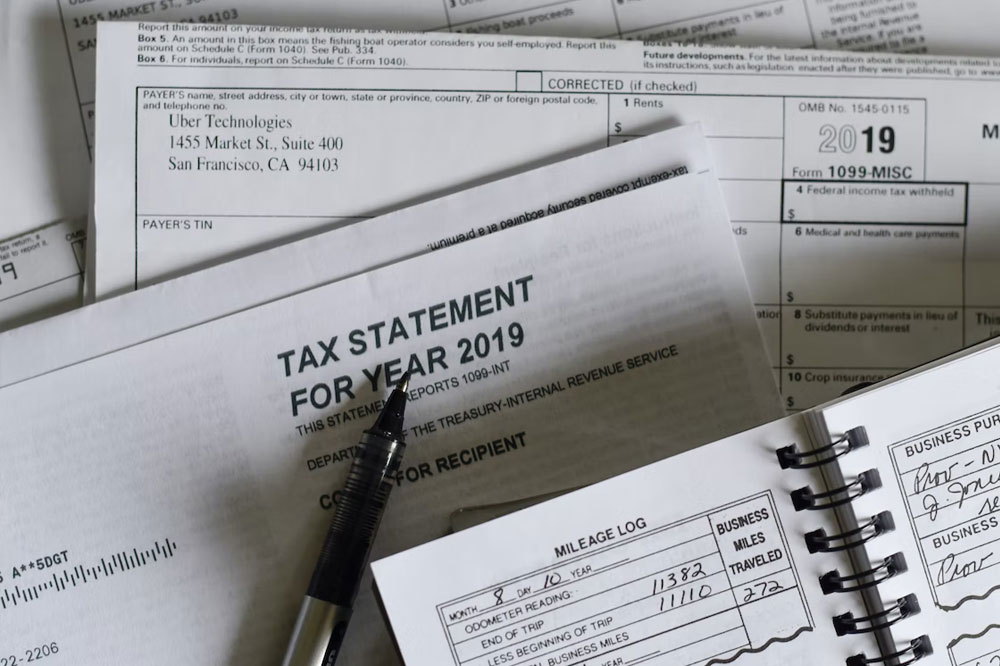

- Tax preparation

- Consulting

A CPA can work with corporations, non-profit organizations, small businesses, individuals, and governments.

Generally, CPAs focus on three areas of specialization.

- Tax services

A CPA may offer tax services to both organizations and individuals. They can file state, federal, and local tax returns and use their knowledge of tax laws to minimize their clients’ tax burdens. If a company or individual faces an IRS audit or questions from state or local authorities, the CPA will represent their clients in resolving the matter.

- Audit and assurance services

Auditing is an evaluation of economic and financial information to ensure accuracy and adherence to generally accepted accounting principles.

Assurance services provide clarity and context for financial and non-financial information so that decision-makers can make informed choices.

- Management services

CPAs may assist with supervising and managing an organization or individual’s daily activities. CPAs can help people develop strategies to reach specific goals and make plans for the long term. Specific services a CPA may offer include”

- Cash management

- Budgeting

- Financial planning

- Preparing financial statements

- Risk management

- Investment guidance

- Estate planning

- Insurance coordination

Find a Wichita CPA Now

A CPA offers high-quality, knowledgeable support and guidance in various financial, insurance, and tax matters. If you are looking for a Wichita CPA, contact the team at Wichita Tax Advisor today to learn more about how we can assist you.