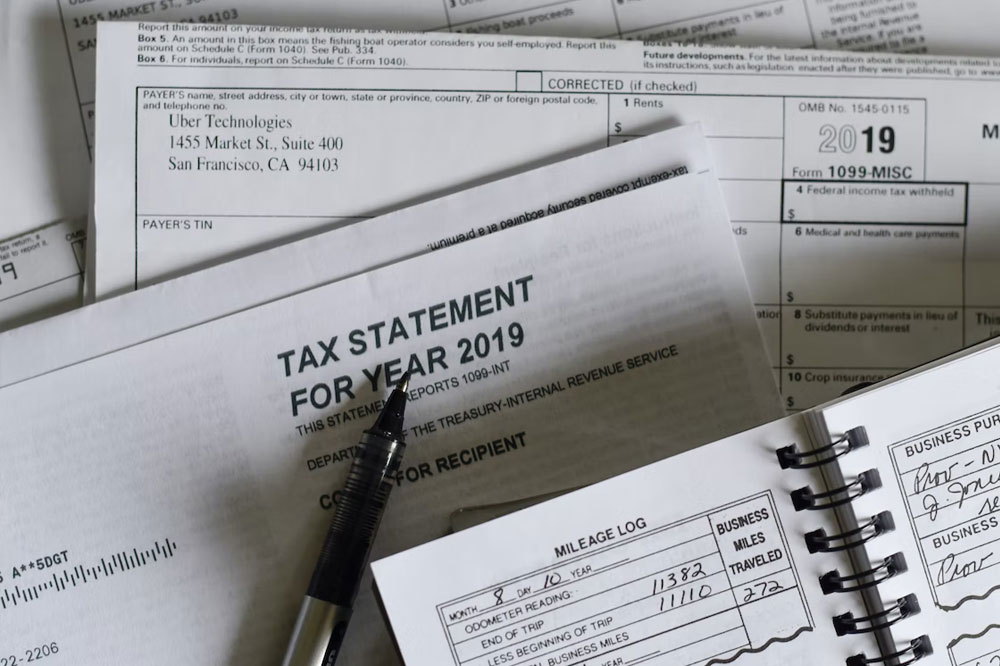

Tax season can be daunting for small business owners, but with careful preparation and organization, you can navigate it smoothly and ensure compliance with tax laws. At Wichita Tax, we specialize in guiding small businesses through the intricacies of tax preparation, offering expert advice and personalized solutions. Whether you’re a sole proprietorship, partnership, LLC, or corporation, our comprehensive tax preparation checklist will help you stay on track and maximize deductions.

1. Organize Financial Documents

Gather all necessary financial documents, including:

- Income statements (Profit and Loss Statements)

- Balance sheets

- Bank statements

- Expense receipts and invoices

- Payroll records

- Business asset purchases and depreciation schedules

2. Review Bookkeeping Records

Ensure your bookkeeping records are accurate and up to date. Reconcile bank accounts, credit card statements, and other financial transactions. Use accounting software or consult with your CPA to maintain organized records throughout the year.

3. Determine Deductions and Credits

Identify potential deductions and tax credits that your business may qualify for, such as:

- Home office deduction

- Business vehicle expenses

- Startup costs

- Employee wages and benefits

- Retirement contributions

- Health insurance premiums

4. Prepare Quarterly Estimated Tax Payments

If applicable, calculate and prepare quarterly estimated tax payments to avoid penalties and interest for underpayment. Consult with your CPA to ensure you’re making accurate payments based on your business income and expenses.

5. Verify Employee and Contractor Information

Ensure all employee and contractor information is accurate and up to date. Prepare and distribute W-2 and 1099 forms to employees and contractors by the IRS deadlines.

6. Review Changes in Tax Laws

Stay informed about changes in tax laws that may affect your business. Consult with your CPA to understand how these changes impact your tax obligations and any new deductions or credits you may qualify for.

7. Plan for Retirement Contributions

Maximize retirement contributions for yourself and eligible employees. Contributions to retirement plans can lower your taxable income and build savings for the future.

8. Consider Depreciation and Asset Purchases

Review depreciation schedules and consider any new asset purchases that may qualify for immediate expensing or bonus depreciation. These deductions can reduce your taxable income for the current tax year.

9. Evaluate Quarterly and Annual Financial Reports

Review quarterly and annual financial reports to identify trends, analyze cash flow, and make informed business decisions. Use these reports to assess your business’s financial health and prepare accurate tax returns.

10. Consult with a CPA or Tax Advisor

Seek guidance from a qualified CPA or tax advisor to ensure compliance with tax laws and maximize tax-saving opportunities. A professional can provide personalized advice based on your business’s unique circumstances and goals.

Why Choose Wichita Tax for Your Small Business Tax Needs?

At Wichita Tax in Colorado, our team of experienced CPAs, tax advisors, and tax planners is dedicated to helping small businesses thrive. We offer comprehensive tax preparation services tailored to your specific industry and business structure. Whether you need assistance with tax planning, IRS representation, or general financial advice, we’re here to support you every step of the way.

Conclusion

Preparing your small business taxes doesn’t have to be overwhelming. By following this ultimate tax preparation checklist and partnering with Wichita Tax, you can ensure compliance, maximize deductions, and focus on growing your business.

For expert guidance on tax preparation in Wichita KS, contact us today and schedule a consultation to discover how our expertise can benefit your small business tax strategy. Let’s navigate tax season together with confidence and success.